THIS PAGE CONTAINS AFFILIATE LINKS. READ THE AFFILIATE DISCLOSURE HERE.

Cryptocurrency Forecasting

Most high net worth investors still think that stocks and shares are the best option which is surprising when you analyze all the data. When assessing stock prices you must carry out extensive research such as if the company has bought their own shares.

If this is the case then the price is too high as it will artificially increase the price. The stock market at present is defying all logic as the companies profits are not increasing but their share price is.

Another factor is the boom and bust cycle which we are approaching. History shows us that it is inevitable that we will go through this once again. When it happens the investors will lose everything which is what happening back in 2008.

To combat this risk either cryptocurrency or gold needs to be part of their portfolio so that it hedges against a potential stock market crash.

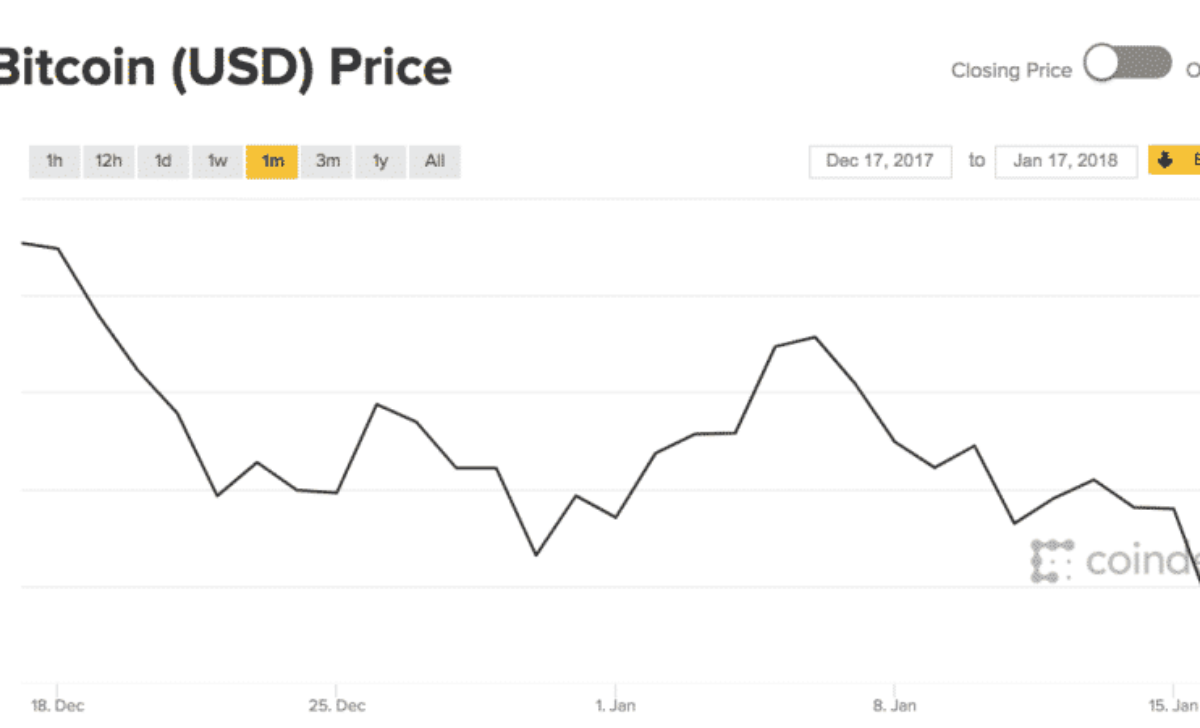

Cryptocurrency Price Forecasting Chart

You can not compare Bitcoin and Cryptocurrency with share valuations as they are measured on different optics than productivity or income stream. Fund managers are not investing presently in crypto. It is due to the fact that it does not have an income stream and they are ignoring all the other benefits of digital currency.

The fact that Bitcoin and cryptocurrency is measured as a money unit it means that the value of BTC has the potential to grow at an exponential rate. It is far greater than any business can make. It does not need building, staff and productivity to grow so the speed in which the value can go up is much faster.

The price of cryptocurrency has been driven by a number of factors and as more people realize the benefits the more interest it will attract. The U.S securities and exchange commission looking to pass a bill with regards crypto. If this gets the green light it will trigger a huge influx of new buyers. If the wealth funds invest.

It will increase the price by over ten times its present value which is why it is still one of the best times to invest in Bitcoin and Crypto. Get a full breakdown of the markets from Matrix Partners partner Josh Hannah by clicking the link below:

Josh Hannah is a general partner at Matrix Partners, and the co-founder of Betfair, an online market for sports betting In this opinion piece, Hannah offers his view on the recent swings in cryptocurrency prices, arguing that whether this activity amounts to a bubble is in the […]

Click here to view original web page at Three Thoughts on the ‘Crypto Bubble’